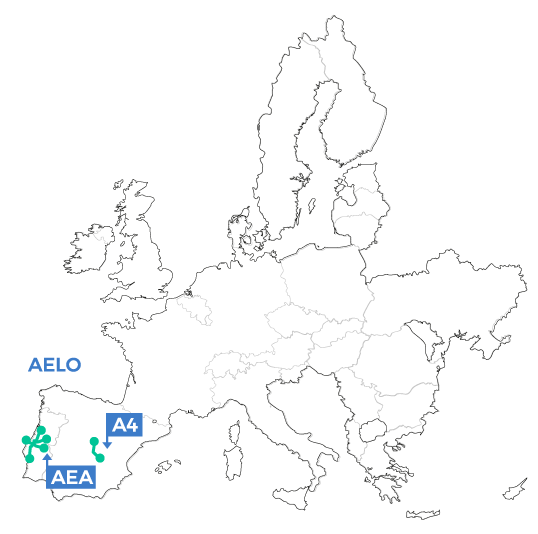

In Portugal, ROADIS manages 272 km of highways in 2 concessions that connect major cities in the country; linking important tourist areas and facilitating connections between several main roads

In Spain, we manage a 64-km concession on the A-4, a key highway that connects the centre and the south of the country. We are responsible for managing, maintaining and operating this asset.

336

3

88,577

RESUMEN ANUAL / SITUACIÓN NACIONAL / SECTOR CARRETERO /

2020 has been a very challenging and difficult year, as the COVID-19 pandemic has created an unprecedented situation worldwide.

This situation has demonstrated, more than ever, the importance of road and highway networks to maintain essential activities. The transport of food, health supplies and essential workers would not have been possible without the existence of an adequate and well-maintained road network, especially in Europe, where very strict closures and restrictions were applied in the early stages of the pandemic.

ROADIS has contributed to this effort by serving the main cities of the countries where we operate, Madrid and Lisbon, where our highways are two of the key access points. Employees of our concessionaires, especially road concessionaires, have once again demonstrated special dedication and an unquestionable level of service and commitment to society at the most uncertain times.

Despite the fact that the COVID-19 pandemic has not yet ended, and its financial consequences are still unresolved and uncertain, ROADIS will continue to work and serve the communities where we operate.

The COVID-19 pandemic has caused an unprecedented shock for the European economy: its effect on economic activity is clearly negative, and there are still doubts regarding the magnitude and duration of the impact. So far, compared to the global economy, the Eurozone has suffered a major blow in 2020 and will experience a slower recovery in 2021.

Experts expect an EU GDP growth rate of -7.0% by 2020, +3.8% in 2021 and +3.8% in 2022. Actual GDP is expected to reach pre-crisis levels in both in the EU and in the Eurozone by mid-2022. These prospects are more positive than the initial forecasts at the beginning of the crisis, but the recovery of economic activity to pre-crisis levels would continue to assume slow growth for EU industry compared to other leading economies.

Another concern for Europe is the increase in unemployment, which has grown considerably in 2020, both in the EU and in the Eurozone, reaching around 8% in the third quarter of 2020. During the remaining months of 2020, it decreased slowly. As a positive note, the EU rate remains far from those recorded following the 2008 financial crisis.

The next generation of EU funds

The COVID-19 pandemic has triggered unprecedented political responses throughout Europe and the world. In July 2020, the EU agreed on a stimulus package of 750 billion euros as a tool to finance countries' post-pandemic recovery. With the aim of making Europe more environmentally-friendly, more digital, more resistant and better adapted to current and future challenges, the €750 billion will be distributed between grants and loans. Italy will be the country that receives the largest amount of funds (163 million euros), followed by Spain (150 million euros) and France (88 million euros).

The road sector in Europe during 2020 was deeply affected by the impact of COVID-19.

Although it has been severely affected during closures and curfews, the road infrastructure sector has proven to be very resistant compared to other transport sectors: traffic, rail and air, which have experienced bigger drops in demand.

Given that the first and second wave of the pandemic affected European countries, the performance of road traffic has varied across the European network: Western and Southwestern countries have been highly affected, while Northern and Northeastern countries have been much less affected.

It should be said that while private and passenger vehicle traffic suffered most during the pandemic in terms of performance, heavy goods traffic was driven during the year by the increase in e-commerce while lockdown restrictions were imposed.

Although hopes for improvement were very high, at the end of 2020, changes to the pandemic during the fourth quarter of 2020 and the first half of 2021 forced the use of curfews and the implementation of new travel restrictions and closures, that have cooled expectations in line with macroeconomic metrics for 2021.

The main opportunities in the primary market are countries with a broad portfolio of new announced PPP projects, such as Germany and Greece, or that are re-bidding for concessions about to expire, such as Greece and Italy. Other countries with smaller but significant projects are Norway, France, Belgium and the Czech Republic.

In Spain, during 2020 there was continued stagnation in road investment and, in particular, in the Road Investment Plan (PIC). However, this plan of some 30 projects is expected to be restarted in 2021. In addition, there could be an additional potential opportunity in the country due to the government's commitment to the EU to charge for the use of highways in the medium term.

As for the secondary market, the outlook is quite competitive. Even taking into account COVID-19, there is still a strong appetite for assets on the market, high liquidity and a reduction in time frames, which helps to reduce discount rates and to increase aggressiveness in base cases.

In Portugal, the secondary market in the toll highway sector was marked by the sale of the 81.1% stake in Brisa -this operation was launched in 2019 and closed in October 2020-. Other operations on the market included the sale of a minority stake in Norte Litoral and Algarve Via do Infante, the sale of the Baixo Alentejo Highway PPP and the sale of the Douro Interior highway.

HOW DO WE CREATE VALUE IN OUR COMMUNITIES?

For another year, the A-4 concession holder has been working together with local communities on actions to improve mobility in urban centres along the A-4, performing actions in coordination with NGOs.

It is also worth mentioning the ongoing cooperation with other road managers, essentially in order to guarantee citizens’ mobility in the best conditions.

In Portugal, several community support actions have been promoted with the sponsorship of different local events, as well as contributing to CSR actions in the fight against COVID-19.

Awards and certifications received by the SBU

AEA

A-4 Madrid-Ocaña

A-4 Madrid-Ocaña

A-4 Madrid-Ocaña

A-4 Madrid-Ocaña

Associations to which the SBU belongs

SEOPAN

CEOE

ASECAP

APCAP

Other ROADIS projects